Wednesday, November 27, 2013

A History of Thanksgiving in the US (1619-present)

This is what we call our annual Thanksgiving re-post, mainly because every year it is quite popular among readers and get a ton of look-ins because of it. So if it looks familiar, that's why.

Nonetheless, this post is chock full of interesting historical tidbits and we hope you enjoy it and your 4-5 day Thanksgiving Holiday weekend.

Unless there's something that happens in the next couple days worth commenting on, we will be back on Monday resuming our passion i.e. informing people of the truth of things..

_________________________________

~ * ~ A History of 'Thanksgiving' in America ~ * ~

December 4, 1619-- 38 English settlers arrived at Berkely Hundred which comprised about 8,000 acres on the north bank of the James River, about 20 miles upstream from Jamestown, Virginia where the first permanent settlement had been established in 1607.

The group's charter required that the day of arrival be observed yearly as a "day of thanksgiving" to God.

During the Indian Massacre of 1622, nine of the settlers at Berkeley Hundreds were killed, as well as about a third of the entire population of the Virginia Colony. The remaining colonists withdrew to Jamestown and other more secure points.

1621-- The modern Thanksgiving holiday traces its origins from a celebration at the Plymouth Plantation, where the Plymouth settlers held a harvest feast after a successful growing season.

This was continued in later years, first as an impromptu religious observance, and later as a civil tradition. The Pilgrims were taught by the Indians how to catch eel and grow corn.

Additionally the Wampanoag Indian leader Massasoithad caused food stores to be donated to the fledgling colony during the first winter when supplies brought from England were insufficient. The Pilgrims set apart a day to celebrate at Plymouth immediately after their first harvest.

1630-- Massachusetts Bay Colony (consisting mainly of Puritan Christians) celebrated Thanksgiving for the first time, and frequently thereafter until about 1680, when it became an annual festival in that colony; and Connecticut as early as 1639 and annually after 1647, except in 1675.

Charlestown, Mass, held the first recorded Thanksgiving observance June 29, 1671 by proclamation of the town's governing council.

1777-- The First National Proclamation of Thanksgiving was given by the Continental Congress commemorating the surrender of British General Burgoyne at Battle of Saratoga.

During the 18th century individual colonies commonly observed days of thanksgiving throughout each year. We might not recognize a traditional Thanksgiving Day from that period, as it was not a day marked by plentiful food and drink as is today's custom, but rather a day set aside for prayer and fasting.

October 3, 1789-- George Washington created the first Thanksgiving Day designated by the national government of the United States, and again proclaimed a Thanksgiving in 1795. President John Adams declared Thanksgivings in 1798 and 1799.

No Thanksgiving proclamations were issued by Thomas Jefferson but James Madison, the 4th President, renewed the tradition in 1814, in response to resolutions of Congress, at the close of the War of 1812. Madison also declared the holiday twice in 1815; however, none of these were celebrated in autumn.

~ "Thanksgiving In Camp"- Winslow Homer

November, 1863-- In the middle of the Civil War, Lincoln prompted by a series of editorials written by Sarah Josepha Hale proclaimed a national Thanksgiving Day, to be celebrated on the final Thursday in November 1863 and since then, has been observed annually in the United States.

During the second half of the 19th century, Thanksgiving traditions in America varied from region to region. A traditional New England Thanksgiving, for example, consisted of a raffle held on Thanksgiving eve (in which the prizes were mainly geese or turkeys), a shooting match on Thanksgiving morning (in which turkeys and chickens were used as targets) then church services.

This was followed by the traditional feast which consisted of some familiar Thanksgiving staples such as turkey and pumpkin pie, and some not-so-familiar dishes such as pigeon pie.

In New York City, people would dress up in fanciful masks and costumes and roam the streets in merry-making mobs. By the end of the century these mobs had morphed into "ragamuffin parades" comprised mostly of costumed children, and by the 20th century the tradition had mostly vanished though is still celebrated in some communities.

1939-- Lincoln's successors as president followed his example of annually declaring the final Thursday in November to be Thanksgiving. But in 1939, FDR broke with this tradition. November had five Thursdays that year (instead of the usual four), and Roosevelt declared the fourth Thursday as Thanksgiving rather than the fifth one.

With the country still in the midst of Great Depression, Roosevelt thought an earlier Thanksgiving would give merchants a longer period to sell goods before Christmas. Increasing profits and spending during this period, Roosevelt hoped, would help bring the country out of the Depression.

At the time, advertising goods for Christmas before Thanksgiving was considered inappropriate. Fred Lazarus, Jr, founder of the Federated Department Stores (later Macy's & also currently Bloomingdales), is credited with convincing Roosevelt to push Thanksgiving back a week to expand the shopping season.

Republicans decried the change, calling it an affront to the memory of Lincoln. People began referring to Nov. 30 as the "Republican Thanksgiving" and Nov. 23 as the "Democratic Thanksgiving" or "Franksgiving."

Many localities had made a tradition of celebrating on the last Thursday, and many football teams had a tradition of playing their final games of the season on Thanksgiving; with their schedules set well in advance, they could not change.

Since a presidential declaration of Thanksgiving Day was not legally binding, Roosevelt's change was widely disregarded. Twenty-three states went along with Roosevelt's recommendation, 22 did not, and some, like Texas could not decide and took both days as government holidays.

October 6, 1941-- Congress passed a joint resolution in 1941 fixing the traditional last-Thursday date for the holiday beginning in 1942. In '40 and '41, years in which November had four Thursdays, Roosevelt had declared the third one as Thanksgiving and as in 1939, some states went along with the change while others retained the traditional last-Thursday date.

After 1941, Thanksgiving became a matter of federal law.

November 29, 1975-- The first documented use of Black Friday in reference to shopping activity on the day after Thanksgiving is in the New York Times for November 29, 1975. Initially it referenced the amount of traffic on that day.

The reference to the financial impact (that it is the day that many retailers begin to show a profit for the year) came a few years later in 1982 on ABC's "World News Tonight".

As a shopping 'day', Black Friday didn't really begin to pick up steam until the mid-late 1990s and then grew and grew into a phenomenon.

Nonetheless, its not the busiest shopping day of the year statistically.. That honor is reserved for December 23rd and 24th when all the people who put off Christmas suddenly realize they may not give a bleep about it but their spouses and children Do, and thus start shopping..

Happy Thanksgiving!

~ 1870 sketch..

Tuesday, November 26, 2013

Monday, November 25, 2013

Depositors Paying Banks to hold Onto Their Money

Yesterday we talked about how utterly foolish it is to keep your excess money (after bills and contingencies) in a bank where you get barely any interest, the bank profits from your holdings, and makes your life super difficult to take real money out...

We're sure most of you nodded or shrugged and left your cash where it is..

To each his/her own..

But let us ask you.. Would you be willing to not only get no interest for a bank holding your money but to pay the bank for the privilege?

From Financial Times:

"Leading US banks have warned that they could start charging companies and consumers for deposits if the US Federal Reserve cuts the interest it pays on bank reserves.

Depositors already have to cope with near-zero interest rates, but paying just to leave money in the bank would be highly unusual and unwelcome for companies and households."

Unusual is putting it mildly..

"Executives at two of the top five US banks said a cut in the 0.25 per cent rate of interest on the $2.4tn in reserves they hold at the Fed would lead them to pass on the cost to depositors."

You see what happens is this.. The banks get money from the Fed but they don't circulate it into the populace via loans. Instead they get paid $$ by the Fed to park that money.. .25%

One quarter of one percent of $2.4 Trillion = $6 billion

To restate: The Evil Federal Reserve creates money out of thin air which becomes public debt, lends their banking buddies that money at near zero interest then pays them collectively $6 billion annually to hold onto that loan

Let it sink in..

And of course if this scenario ever came about, where depositors were charged a fee we can see the vast majority of the populace allowing this

What can we say.. To put it blunt, we live in a cowardly nation in a state of constant fear of the unknown and even worse, we don't trust ourselves.

We fear the notion of terrorism to such an irrational degree, we willingly give up our Constitutional freedoms such as those stripped via the Patriot Act and the experience of being frisked n' fondled and our bags ransacked every time we visit an airport TSA station...

Just to feel a teensy-weensy bit safer... Then drive 90mph on the local interstate highway among texters, tweeters, drinkers and the self medicated..

We fear each other as people so deeply and irrationally, we'd rather text or "sext" another person thousands of miles away then god-forbid give someone in a supermarket or store a friendly or flirty smile that's standing 2 feet away..

Then again put that same person in a bar or nightclub, watch them swig down a few drinks and suddenly he or she possesses miraculous confidence to socially interact face to face.

We also fear the imaginary home burglar so much and the notion he will just magically know the money is kept inside a pair of black socks in the top drawer, we willingly entrust our life savings to the filthiest filth slime to ever exist short of professional Investors.. bankers

We fear the law.. we fear each other.. And no one really questions much of anything anymore..

We know this would never happen but in theory, if every adult man and woman in the USA (the US total pop. is 315 million but 250 million are adults) took out a mere $100 from their checking account at the same time on the same day...

250m people x $100 x 10 (fractional reserve lending) equals $250 billion dollars banks would not have at their disposal to lend or make profit from...

The banks would be crippled.. deservedly so..

They'd have to run back to their mama Fed's teat for some suckling and fresh capital..

As we said.. it will never happen unless there's a bank run, and government will do all it can via institution of capital controls to ensure the banks are protected at all costs even if you as an individual perish..

We know Thanksgiving is rapidly approaching and the focus this week for most is on turkey, family and shopping.. Not 'heavy' stuff..

But we'd like to think or hope the human mind can digest multiple concepts at a given time without picking the either/or of 'holiday' vs' reality.

Then again..

So tomorrow's post will be Thanksgiving themed and that will carry A&G until the following Monday..

And when your sitting at the dinner table with plate full of gobblety-good deliciousness this Thursday and you give Thanks...

Be appreciative that you still have time to protect your financial interests and for blogs like ours that want to educate on the reality of things while asking/seeking nothing in return.

The Difference between being Rich and possessing Wealth

Today we're going to talk about two terms that seem to be one and the same theoretically but in a true everyday life sense are not..

Being rich and Being wealthy.

To explain this concisely we will use two women: Allie and Bea

Allie is a 45yr old normal everyday person.. She's not poor but not middle class.. She's a hustler in the good sense of the word working one job to the next while trying to survive and build a mini nest egg.

Because she lives in the city, she uses public transportation to get around, and currently is renting an apartment, splitting the cost with a roommate.

And because of either a deep mistrust of banks and/or government pretty much her entire life savings is in cash; kept literally in a coffee can where no one but her can find it --

All $35,000 of it..

Now Bea is a very successful woman by all accounts. She owns her own business and has made enough money over the years to allow her as a single woman to own her own home, two cars, etc..

Bea is not a 'millionaire' but lives a very comfortable life surrounded by beautiful things. Her income is somewhat consistent so it gives her the freedom to shop for nice things with the means of paying back in full, and she even invests in the stock market.

Bea has a net worth of over $750k but only has $12,600 in her bank, most of which is in a money market because with her lifestyle, its not practical to hoard cash.

OK, now who is richer.. Allie or Bea?

Obviously its Bea. No brainer there..

But... Who is wealthier?

The answer is.. it depends.

Now if both women went to the banks seeking loans, Bea would have a far easier time acquiring one than Allie. She'd also get better financing than Allie if both sought to buy the same car, etc..

It is fair to say that within the perfectly working construct which is this Matrix or "System" we live in, Bea is also wealthier.

OK, now let's peel the onion to delve deeper..

Let us say the nation is attacked again like 9/11.. Or market crash.. Or something totally unexpected..

Who would be wealthier, Allie or Bea?

Remember after 9/11, the stock market was closed for four days and during that time you could not access your stocks for purposes of cashing out. You also could not touch your CDs or get into your money market account...

In this situation, Bea would only have whatever funds she kept in her checking account until such time as things normalized.

Allie would have $35,000 at her disposal.

Or lets say circumstances required the immediate need for $20,000 cash.. Doesn't matter if for legal or illegal purposes..

Could be bailing out someone you care about out of a really bad fix or else he/she will be greatly harmed..

Could be a margin call after your stock tanked..

Who is wealthier in an emergency-- Allie or Bea?

Bea has all her money tied up in property and possessions; very difficult to sell a car in less than a day and hawking jewelry gets you 15 cents on the dollar..

Allie has $35,000 in cash.

Now it certainly would be painful and even foolhardy for her to part with over half of her lifetime nest egg.. and we will trust she is sensible not to.

But in emergencies or any circumstance where the System breaks down or one needs to conduct business privately away from its prying eyes, Allie is in total power; she holds all the cards.

Bea owns things.. objects that can not be quickly liquidated.

The longer something occurs natural or man made that either requires large amounts of cash or prevents her access to what funds she possesses, the worse off she'll be.

A person can be both wealthy and rich..

But you do not have to be rich in order to possess wealth.

You simply have to literally possess your cash.

When you put your money in a bank, you are limited as to how much you can access at any given time.

Try taking $1,000 out of an ATM machine. You will be told there is a daily limit of perhaps $500-$600 you can withdraw.

Try going up to your bank teller and withdrawing $20,000 in cash... In all likelihood you will be either told to come back when the bank possesses it or made to wait and wait while heavily scrutinized...

They will also report it to the IRS and every other government agency that monitors such things..

If you want to experience what its like to feel like a criminal, attempt to withdraw at least $8,000 of your own money from your own account... Then ask for it to be in $20's

If you use your credit/debit card to make purchases, there's daily limits as to what can be charged even if you possess more than enough funds in your account to cover, and if you make a purchase that the bank doesn't seem to think is 'normal' for you, it will decline you and/or freeze your account

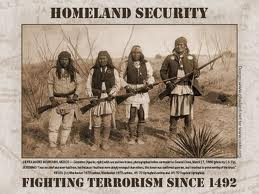

~ An example of Native American historical PC revisionism...

They're pretend its for your benefit.. a safety protection against fraudulent use. But its not.. The bank wants to control your money and your ability to access it.

That is why a person should only keep enough funds to pay bills and cover emergencies.

For example, and we know this is not practical or doable for most and we respect that... Nonetheless, if your bills for a given month run you $2500, there's no reason to keep more than $3500 in a bank.. The rest should be withdrawn.

And if one needs to write a larger check at a given moment, one simply deposits the cash needed to cover that check beforehand..

~ And an example of Native American historical Truth

Cash unlike checks process immediate to one's bank account.

Pretty much in all aspects of life, cash can still be used rather than credit so why not use it? Why leave a paper trail that says you went to WalMart on X-day at X-o'clock then spent X to eat at Olive Garden..

Cash is convenience and its privacy.

And for all the fear that robbers will break in and know you kept all your cash inside a box of Shredded Wheat, the real robbers are the banks that hold onto your cash, control every aspect of your access to it, charge you fees to acquire your own money and record/report your movements to others.

~ And another..

Then the banks take your money which you get basically zero rate of return in interest, then via fractional reserve lending, are able to lend out 10x the amount acquired by you to others for home and car loans at 5-10% interest

So to finish the example from the beginning of this post, Bea may be richer.. Own more possessions and live an overall more comfortable life..

But if/when society or the system breaks down even briefly, it will be Allie and her $35k cash in the drivers seat, able to make the best choices and enjoy a level of comfort that Bea for all her homes, cars, and credit cards will be denied.

Being rich and Being wealthy.

To explain this concisely we will use two women: Allie and Bea

Allie is a 45yr old normal everyday person.. She's not poor but not middle class.. She's a hustler in the good sense of the word working one job to the next while trying to survive and build a mini nest egg.

Because she lives in the city, she uses public transportation to get around, and currently is renting an apartment, splitting the cost with a roommate.

And because of either a deep mistrust of banks and/or government pretty much her entire life savings is in cash; kept literally in a coffee can where no one but her can find it --

All $35,000 of it..

Now Bea is a very successful woman by all accounts. She owns her own business and has made enough money over the years to allow her as a single woman to own her own home, two cars, etc..

Bea is not a 'millionaire' but lives a very comfortable life surrounded by beautiful things. Her income is somewhat consistent so it gives her the freedom to shop for nice things with the means of paying back in full, and she even invests in the stock market.

Bea has a net worth of over $750k but only has $12,600 in her bank, most of which is in a money market because with her lifestyle, its not practical to hoard cash.

OK, now who is richer.. Allie or Bea?

Obviously its Bea. No brainer there..

But... Who is wealthier?

The answer is.. it depends.

Now if both women went to the banks seeking loans, Bea would have a far easier time acquiring one than Allie. She'd also get better financing than Allie if both sought to buy the same car, etc..

It is fair to say that within the perfectly working construct which is this Matrix or "System" we live in, Bea is also wealthier.

OK, now let's peel the onion to delve deeper..

Let us say the nation is attacked again like 9/11.. Or market crash.. Or something totally unexpected..

Who would be wealthier, Allie or Bea?

Remember after 9/11, the stock market was closed for four days and during that time you could not access your stocks for purposes of cashing out. You also could not touch your CDs or get into your money market account...

In this situation, Bea would only have whatever funds she kept in her checking account until such time as things normalized.

Allie would have $35,000 at her disposal.

Or lets say circumstances required the immediate need for $20,000 cash.. Doesn't matter if for legal or illegal purposes..

Could be bailing out someone you care about out of a really bad fix or else he/she will be greatly harmed..

Could be a margin call after your stock tanked..

Who is wealthier in an emergency-- Allie or Bea?

Bea has all her money tied up in property and possessions; very difficult to sell a car in less than a day and hawking jewelry gets you 15 cents on the dollar..

Allie has $35,000 in cash.

Now it certainly would be painful and even foolhardy for her to part with over half of her lifetime nest egg.. and we will trust she is sensible not to.

But in emergencies or any circumstance where the System breaks down or one needs to conduct business privately away from its prying eyes, Allie is in total power; she holds all the cards.

Bea owns things.. objects that can not be quickly liquidated.

The longer something occurs natural or man made that either requires large amounts of cash or prevents her access to what funds she possesses, the worse off she'll be.

A person can be both wealthy and rich..

You simply have to literally possess your cash.

When you put your money in a bank, you are limited as to how much you can access at any given time.

Try taking $1,000 out of an ATM machine. You will be told there is a daily limit of perhaps $500-$600 you can withdraw.

Try going up to your bank teller and withdrawing $20,000 in cash... In all likelihood you will be either told to come back when the bank possesses it or made to wait and wait while heavily scrutinized...

They will also report it to the IRS and every other government agency that monitors such things..

If you want to experience what its like to feel like a criminal, attempt to withdraw at least $8,000 of your own money from your own account... Then ask for it to be in $20's

If you use your credit/debit card to make purchases, there's daily limits as to what can be charged even if you possess more than enough funds in your account to cover, and if you make a purchase that the bank doesn't seem to think is 'normal' for you, it will decline you and/or freeze your account

~ An example of Native American historical PC revisionism...

They're pretend its for your benefit.. a safety protection against fraudulent use. But its not.. The bank wants to control your money and your ability to access it.

That is why a person should only keep enough funds to pay bills and cover emergencies.

For example, and we know this is not practical or doable for most and we respect that... Nonetheless, if your bills for a given month run you $2500, there's no reason to keep more than $3500 in a bank.. The rest should be withdrawn.

And if one needs to write a larger check at a given moment, one simply deposits the cash needed to cover that check beforehand..

~ And an example of Native American historical Truth

Cash unlike checks process immediate to one's bank account.

Pretty much in all aspects of life, cash can still be used rather than credit so why not use it? Why leave a paper trail that says you went to WalMart on X-day at X-o'clock then spent X to eat at Olive Garden..

Cash is convenience and its privacy.

And for all the fear that robbers will break in and know you kept all your cash inside a box of Shredded Wheat, the real robbers are the banks that hold onto your cash, control every aspect of your access to it, charge you fees to acquire your own money and record/report your movements to others.

~ And another..

Then the banks take your money which you get basically zero rate of return in interest, then via fractional reserve lending, are able to lend out 10x the amount acquired by you to others for home and car loans at 5-10% interest

So to finish the example from the beginning of this post, Bea may be richer.. Own more possessions and live an overall more comfortable life..

But if/when society or the system breaks down even briefly, it will be Allie and her $35k cash in the drivers seat, able to make the best choices and enjoy a level of comfort that Bea for all her homes, cars, and credit cards will be denied.

.jpg)

.jpg)